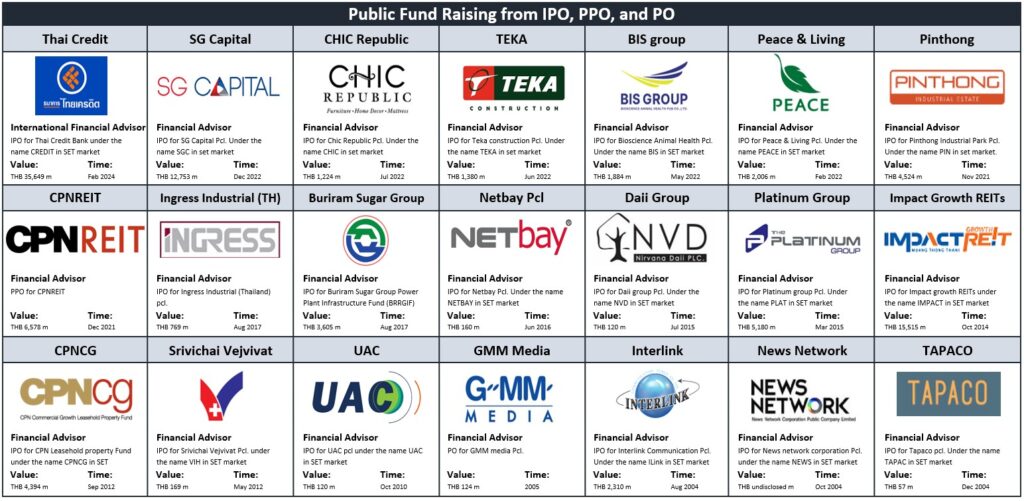

We are under the list of SEC approved IPO Financial Advisor.

What is an Initial Public Offering ?

An Initial Public Offering (IPO) is the process of offering shares of a private company to the public for the first time through the stock exchange. When a company “goes public,” it becomes listed on the Stock Exchange of Thailand (SET) or Market for Alternative Investment (mai) and can raise capital by selling equity to investors – Thailand IPO services

🎯 Advantages of Going Public (IPO) in Thailand

An Initial Public Offering (IPO) is more than just raising capital — it’s a strategic leap that delivers long-term value to the business, shareholders, and stakeholders alike. Here’s a breakdown of who benefits from an IPO and what they gain:

✅ Key Benefits of IPO for the Company

Access to Capital Without Debt

Raise large amounts of capital through equity without incurring interest-bearing liabilities.Improved Corporate Image & Credibility

Enhanced reputation builds trust with customers, partners, and financial institutions — potentially lowering your cost of borrowing.Attract Strategic Partnerships

A public profile increases brand visibility and creates more B2B opportunities.Professionalism & Accountability

Public companies typically operate with stronger internal governance and transparency.Employee Pride & Retention

A listed company often inspires greater pride and may offer stock incentives to attract top talent.Corporate Tax Benefits

Enjoy tax privileges on dividend income under Thai law.

👨👩👧👦 Benefits for Existing Shareholders

Liquidity & Exit Opportunities

Shareholders can convert equity into cash, diversify their portfolios, or plan for wealth management.Tax Advantages on Capital Gain

Potential tax benefits for capital gains from the sale of shares.Greater Shareholder Protection

Thai SEC enforces fair disclosure and transparency for all investors.Reduced Personal Risk

Public ownership may remove the need for personal guarantees tied to company loans.Family Business Planning

An IPO can simplify succession planning and reduce family disputes through clear ownership structure.

💳 Why Creditors Welcome Your IPO

Improved Balance Sheet

Capital raised through equity lowers the debt-to-equity ratio and signals financial health.Better Lending Terms

Lenders may feel more confident to extend credit with reduced risk exposure.

🙋♂️ Confidence for Minority Shareholders & Investors

Stronger Investor Confidence

With formalized reporting, minority shareholders feel more secure and protected under public disclosure rules.

IPO Timeline in Thailand

Preparing for an IPO in Thailand generally takes around 18–24 months, depending on the company’s initial readiness, industry, and regulatory complexity. Below is the updated timeline with all key phases:

| Phase | Key Activity | Estimated Duration |

|---|---|---|

| Phase 1 | Feasibility Study & Advisor Appointment | 2–3 months |

| Phase 2 | Internal Restructuring & Financial Audit Preparation | 6–8 months |

| Phase 3 | Financial & Legal Due Diligence | 3–4 months |

| Phase 4 | Filing Submission to SEC & Review Process | 4–6 months |

| Phase 5 | Roadshow, Bookbuilding, Pricing | 1–2 months |

| Phase 6 | IPO Launch & Stock Exchange Listing | ~1 week |

| Phase 7 | Post-IPO Reporting & Governance (Ongoing) | Continuous |

🔁 Note: The timeline may extend if your company needs more time for audited financials (usually 2–3 years of financial statements) or corporate restructuring before submission.

📌 Is an IPO Right for You?

An IPO can unlock major growth potential — but it requires expert planning and precise execution. That’s where we come in.

Our Role as your IPO Consultant in Thailand, we help you navigate the full IPO journey — from pre-IPO assessment, corporate restructuring, financial reporting, and SEC filing, to roadshows and post-listing compliance.

Click Here to Contact us for a free IPO consultation.

Our Team IPO Experience